How much water does AI really use?

This Week in Charts: October 24, 2025

How much water does AI really use?

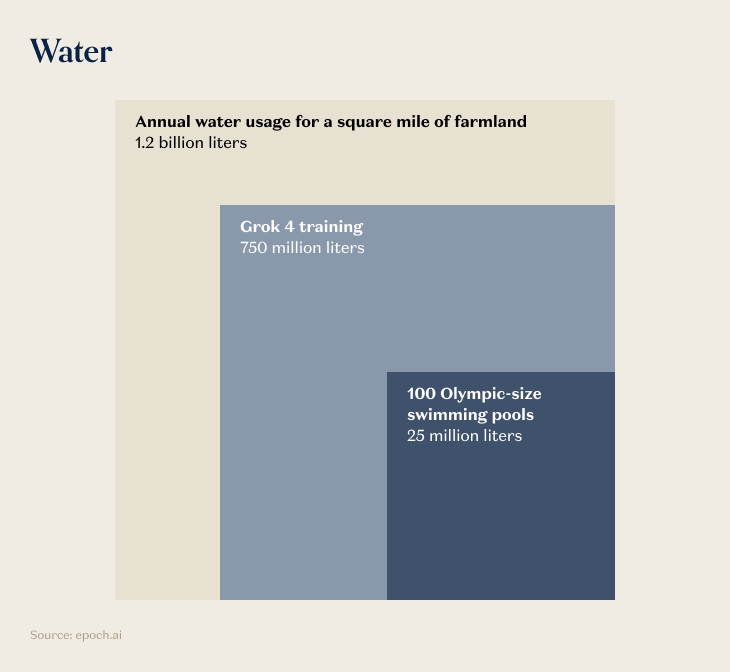

It took an estimated ~750 million liters of water to train Grok 4, which is likely the largest pretrained model ever publicly released, with an estimated 5e26 FLOPs of training compute.

While 750 million liters sounds like a lot, it’s less than two-thirds the amount of water consumed by a single square mile of farmland–and there are about 1.37 million square miles of farmland in the US alone.

The impact of AI on water consumption is basically negligible, at scale.

“AI consumes all the water” has been a doomer meme for a while now. Most recently, the WSJ wants you to know that “Open AI’s GPT-3 model . . . consumes the equivalent of a 16.9-ounce bottle of water for every 10 to 50 responses it provides.” And sure, when you pick a tiny unit of measurement, that can sound pretty scary–just like if the WSJ said “it takes 2.4 billion bottles of water to irrigate a single square mile of farmland.” The reality is, though, that water is pretty low on the list of AI-related resource constraints.

Electricity? That’s a different matter, but water isn’t a thing.

Putting $10B-$100B in perspective (you can’t)

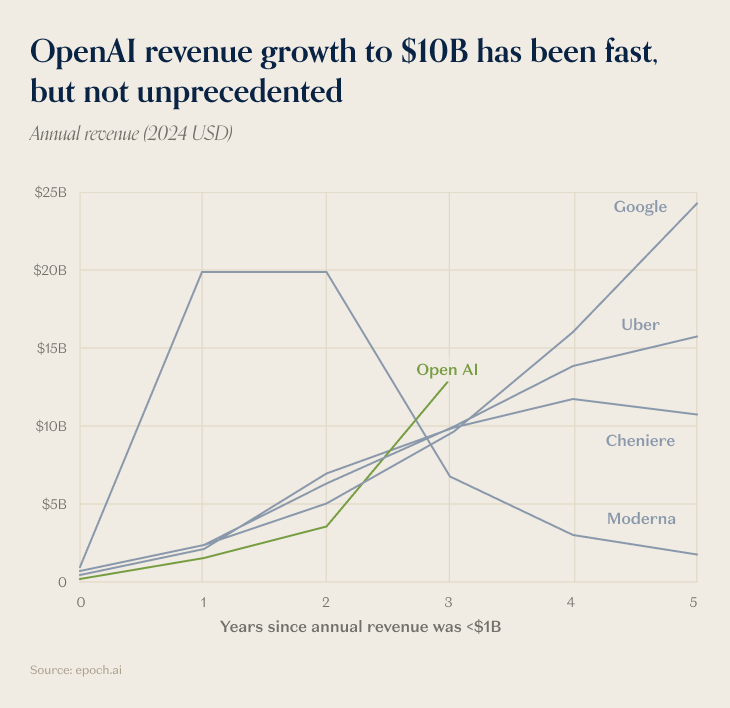

Getting to $10B in three years is very fast, but it’s comparable to growth we’ve seen before from companies like Google and Uber, and even an energy company (Cheniere). In fact, the fastest run to $10B belongs to Moderna, whose revenue spiked during the pandemic.

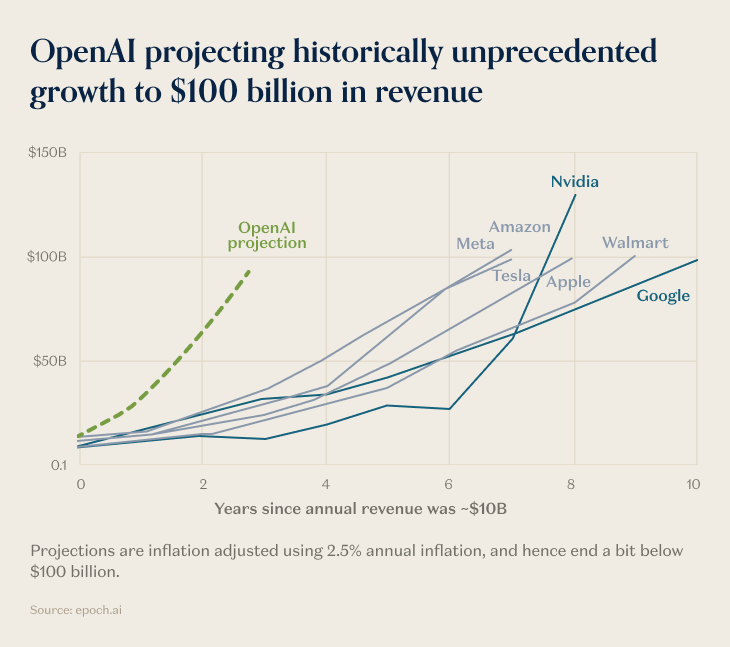

The next leg, from $10B to $100B, is truly rarefied air. Of the seven US companies that have gone from $10B-$100B in less than a decade, no company has ever done it in less than ~7-years. ByteDance, the TikTok parentco, did it in 5. OpenAI believes it can do it in 3.

But, these are unprecedented times, with unprecedented growth, so who’s to say it can’t be done?

The lesser-known winner of the AI Capex Supercycle

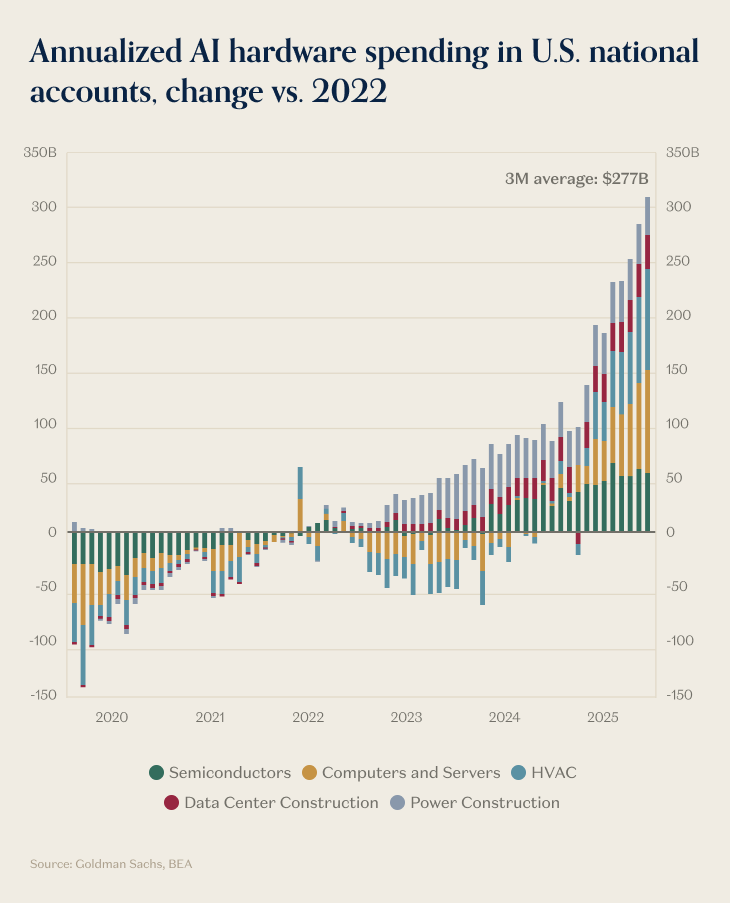

Everyone knows that AI has triggered a massive investment cycle in the world of atoms, with ~50% of GDP growth attributable to AI Capex alone.

The lion’s share of that investment has flowed to the most likely categories: semis, computers/servers, and of course, data centers themselves, where the cumulative increase in annual investment (relative to 2022) for those categories alone is ~$175B. None of those, however, are the biggest winner of net-new hardware spending.

The biggest winner is actually HVAC, where annual spending has increased ~$100B from 2022, the largest increase for any single category of the AI hardware spending spree.

Nvidia gets all the headlines, but it turns out that cooling and ventilating all that compute is an increasingly important part of the picture. Can’t spend billions on GPUs and have them melt themselves every time sama does a feature launch.

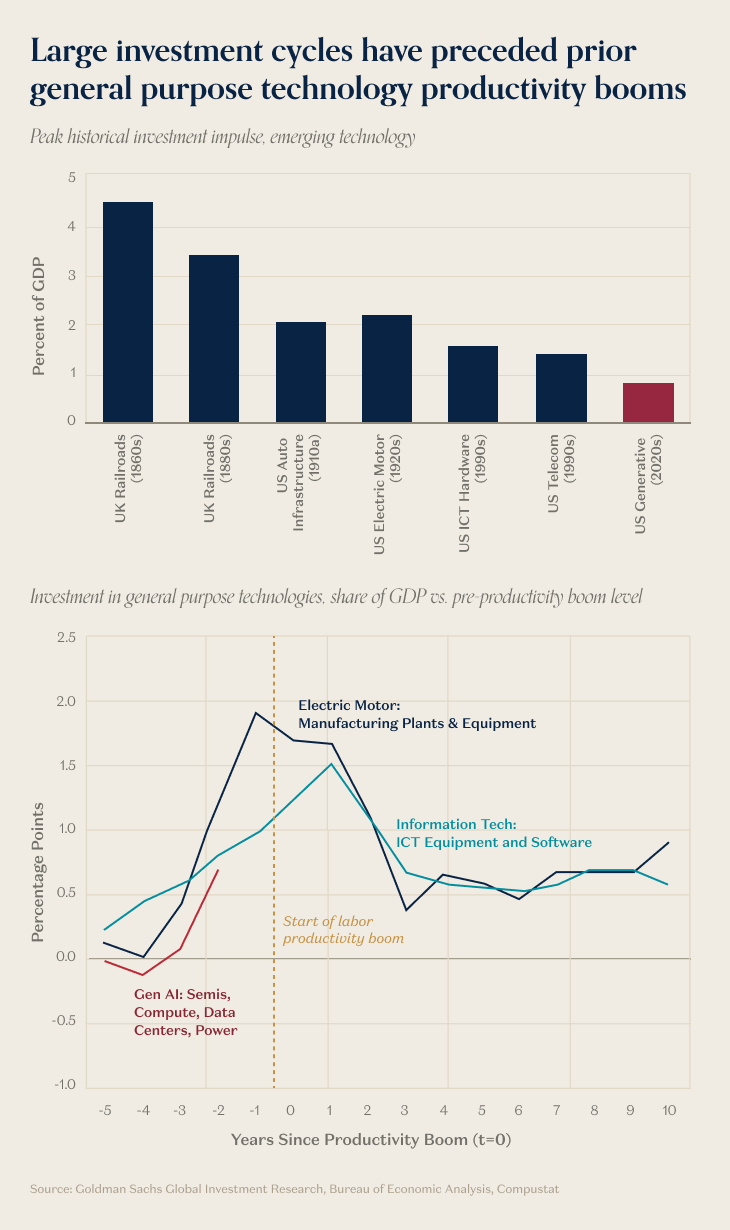

AI Capex Supercycle, still the short-stack

The AI Capex supercycle is big (and getting bigger), but it’s not that big relative to some of the previous “general purpose” builds.

At less than 1% of overall GDP, AI investment pales in comparison to say, railroads (which peaked between 3.5%-4.5% of GDP) or even telcos (which ran to ~1.5% of GDP).

The key, of course, isn’t the relative size of the investment, but the productivity gains that are expected to follow–and those may take some time. In the cases of electric motors, or the tech investments from the 90’s, it took 4-5 years for the productivity gains to really start popping off.

Nothing ventured, nothing gained.

Massive technological shifts require massive investment, which necessarily lead the productivity payoff, often by years. The “GDP impulse” of AI Capex isn’t even that big yet, in the big scheme of GPT cycles, and given that we’ve only been at it for ~2-3 years, we’ve barely scratched the surface of the payoff, by any reasonable timeline.

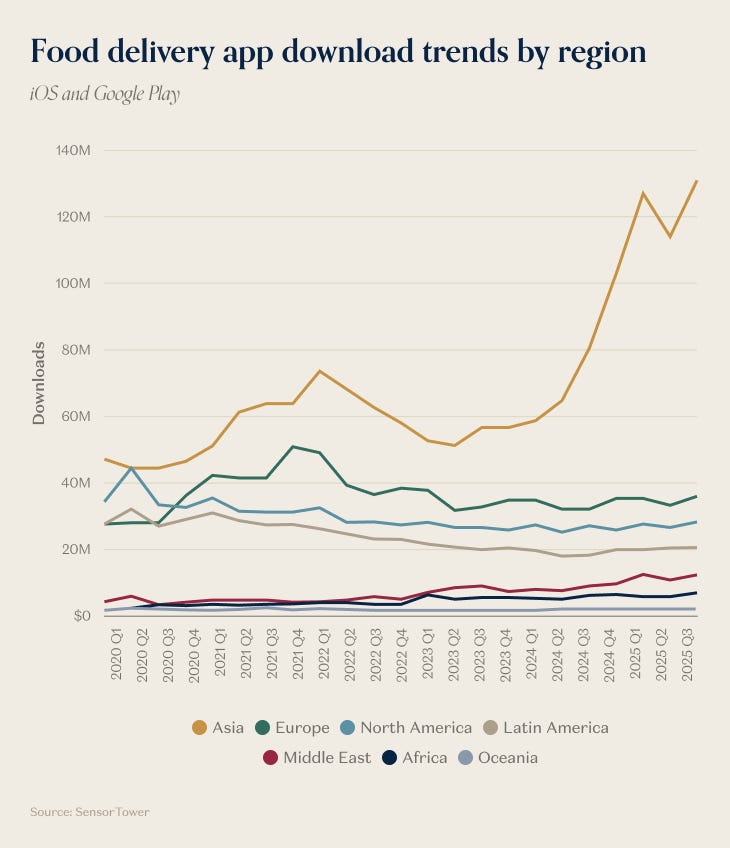

Asia discovers food delivery apps

Downloads for delivery apps in Asia have exploded since 2024, with quarterly downloads more than doubling in less than two-years (according to SensorTower data).

Ultra-fast grocery in India (bigbasket, Blinkit, and Zepto) have led the charge recently, where 1H 2025 downloads were just under 200M.

The surge is remarkable given that downloads have been mostly flat-to-down everywhere else in the world (including Asia, at least until recently).

Just when you thought a category was out, it keeps pulling you back in.

Network density in India makes it especially well-suited for rapid grocery delivery, but the bigger takeaway here is that there are always new lands to conquer, even when the narrative says the market is fully mature.

Views expressed in “posts” (including podcasts, videos, and social media) are those of the individual a16z personnel quoted therein and are not the views of a16z Capital Management, L.L.C. (“a16z”) or its respective affiliates. a16z Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell — or a solicitation of an offer to buy — any securities, and may not be used or relied upon in evaluating the merits of any investment.

The contents in here — and available on any associated distribution platforms and any public a16z online social media accounts, platforms, and sites (collectively, “content distribution outlets”) — should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here or on a16z content distribution outlets are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, posts may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein. All content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website — or on associated content distribution outlets — be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles — which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters.

There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available here: https://a16z.com/investments/. Past results of a16z’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Excluded from this list are investments (and certain publicly traded cryptocurrencies/ digital assets) for which the issuer has not provided permission for a16z to disclose publicly. As for its investments in any cryptocurrency or token project, a16z is acting in its own financial interest, not necessarily in the interests of other token holders. a16z has no special role in any of these projects or power over their management. a16z does not undertake to continue to have any involvement in these projects other than as an investor and token holder, and other token holders should not expect that it will or rely on it to have any particular involvement.

With respect to funds managed by a16z that are registered in Japan, a16z will provide to any member of the Japanese public a copy of such documents as are required to be made publicly available pursuant to Article 63 of the Financial Instruments and Exchange Act of Japan. Please contact compliance@a16z.com to request such documents.

For other site terms of use, please go here. Additional important information about a16z, including our Form ADV Part 2A Brochure, is available at the SEC’s website: http://www.adviserinfo.sec.gov

Would have loved to see inference water usage too. I suppose that'd be more water usage than training itself? And not to mention, many people use open source models through cloud platforms. Would have appreciated a bigger overview instead of a single chart.

Didn't expect this take on the subject, but it's really well-argued. I particulary appreciated the clarity around 'negligible, at scale'. That perspective is crucial for debunking the sensationalist claims we often see in media about AI's impact.