Charts of the Week: Open model of choice?

A flip in open model dominance; HVAC gets paid; Broadcast TV makes a comeback (using one neat trick); AI Efficiency (or is it); An under-the-radar leading signal for M&A

Open season on open source

Steve Hsu coined the “skull graph moment” as the point at which an upstart overtakes an incumbent with a rate-and-pace-of-change that not only closes a previously “insurmountable” gap, but begins to create a new one, in favor of the challenger.

US-made open models just recently had something of a skull-graph moment with respect to Chinese models. For ~1.5 years, US models enjoyed a pretty fat lead as the global “open model of choice,” at least measured by downloads, but in March 2025 that began to change: Chinese model adoption began to accelerate rapidly.

In a span of less than 6 months, cumulative downloads of Chinese open models had not only overtaken US models, but began to open a widening lead. A good chunk of that Chinese overtake is driven by Qwen’s popularity as an open-source model (at the expense of Llama).

For example, Brian Chesky just told the world “we’re relying a lot on Alibaba’s Qwen. It’s very good. It’s also fast and cheap . . . we use OpenAI’s latest models, but we typically don’t use them that much in production because there are faster and cheaper models.”

To be fair, US model adoption has reaccelerated recently, as well, but the point stands: the race for model dominance is definitely on (and just getting started). The other lesson here is that, given how quickly the ecosystem is evolving, the competitive landscape today will (probably) look nothing like the landscape one year from now (let alone five years from now). In all events, the time to build is now, same as it ever was, only more so.

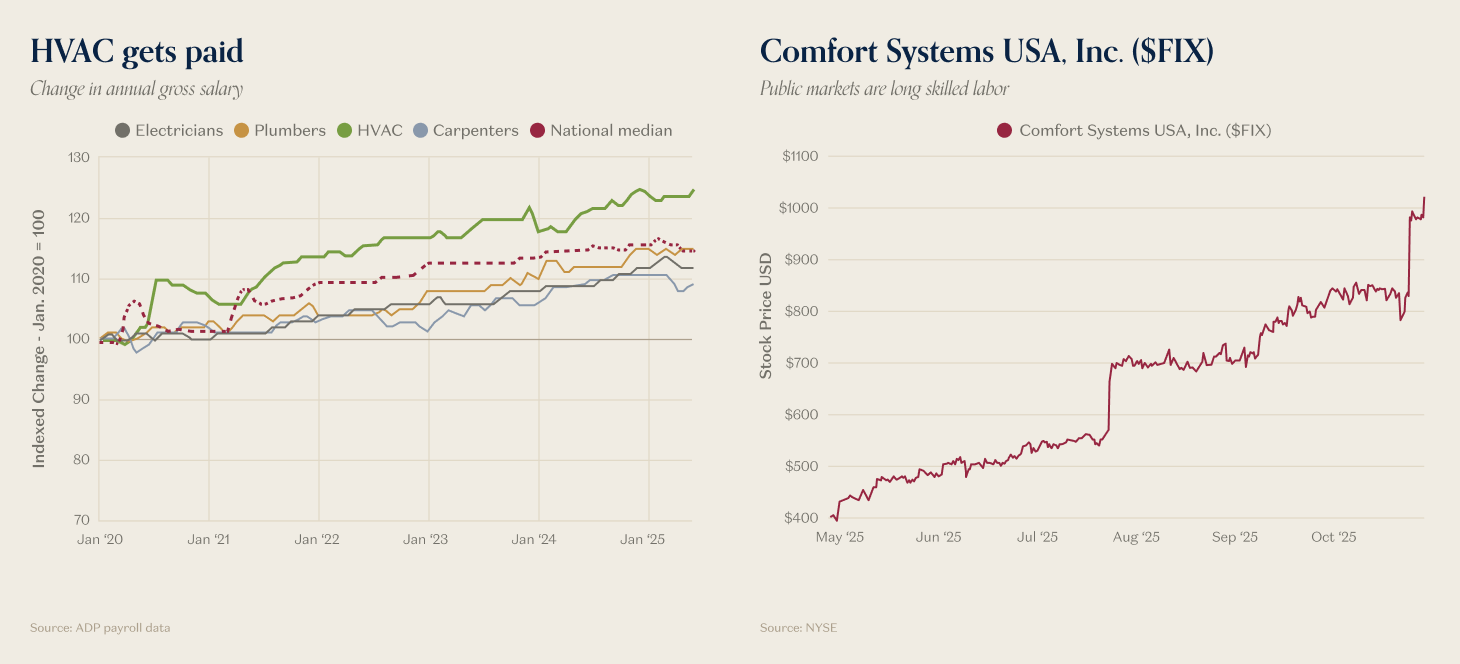

Help Wanted: HVAC

While everyone knows the skilled trades are in short-supply, no skilled-trade is more bottlenecked than HVAC.

The wage premium for HVAC workers is ~25% since 2020, which is more than double the median gross salary increase nationwide (and more than double the premium for the other skilled trades, like electricians, plumbers and carpenters).

Public markets have noticed, as well. The share price for Comfort Systems USA FIX 0.00%↑ (which supplies skilled labor to big industrial projects) looks more like a staircase than a price chart with every earnings release.

Secular aging, plus the AI Capex Supercycle, have made it an increasingly good time to be skilled in the world of atoms. The college wage premium may have gone flat, but if you know a thing or two about industrial cooling, you can write your own check.

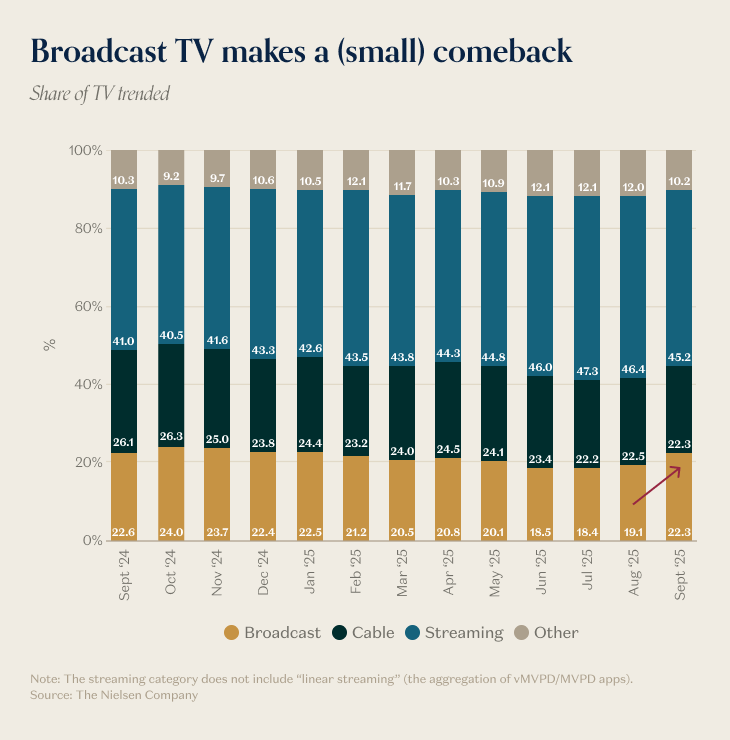

Sportsball to rule them all

After years of relentless marketshare capture by streaming at TV’s expense, streaming actually took a step back, recently.

Streaming peaked at nearly 50% of viewing time in July 2025, but has regressed slightly to ~45%, as cable, but especially broadcast, mounted something of a comeback.

Broadcast’s streaming share jumped just under 20% from August to September, which is not only the largest MoM increase in Nielsen’s series, but represents the first time that Broadcast surpassed Cable.

The culprit? Live sports: NFL and NCAA football drove a 3x shift in sports viewership (which comprises a full third of Broadcast’s screentime).

There’s a reason that Prime, Netflix and others have set their sights on live sports (and why investment in alternative sports leagues, continues to proliferate): the people love sportsball. Sports is the thing more than any other thing that dictates platform preferences—the proverbial ‘king of the hill’ in the attention economy.

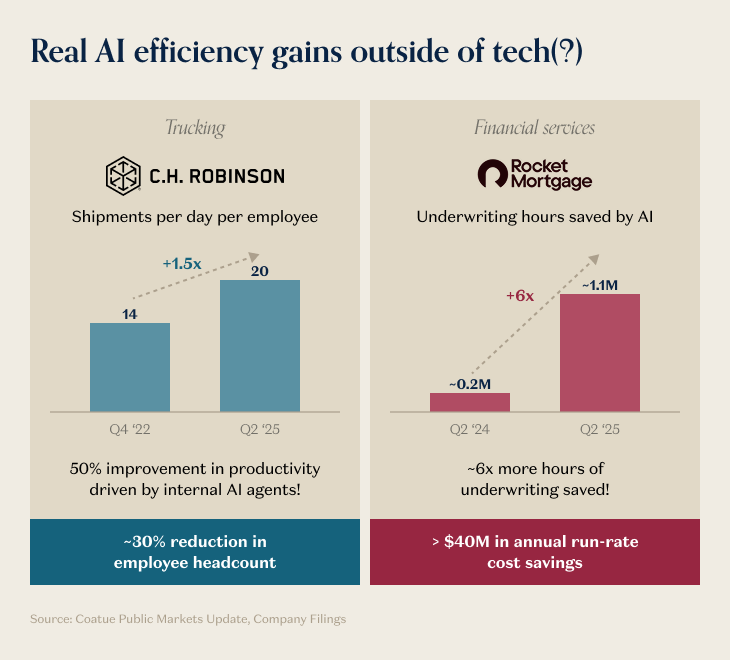

AI payback is hard to measure (or is it)?

Coatue recently made the point that AI payback can be a bit hard to measure because it can manifest in multiple ways, both as a lift to top-line, but also a shrink to bottom-line (and sometimes at the same time).

Coatue gave two examples of AI “efficiency gains” outside of tech: a shipping company increasing shipments per employee by 1.5x (translating to a ~30% reduction in headcount), and a mortgage company reporting a 6x increase in saved underwriting time (for ~$40M in annual run-rate savings).

That’s true, so far as it goes, but it’s very possible something else is afoot, having nothing to do with AI: a cyclical increase in utilization rates (and rate-driven headcount reductions).

Taking Rocket as an example, not only had mortgage origination volume slowed precipitously in Q4 ‘22, Rocket Mortgage (and pretty much everyone else) made substantial cuts to headcount—~$500M decrease from ‘22-’23—in anticipation of a rate-driven economic slowdown (that never really came). The net-result is a mechanical increase in “productivity” that probably isn’t AI-related, in the main.

AI gains are real, and will, in fact, manifest in hard to measure ways, so kudos to Coatue for surfacing that point. Plus, just because Rocket wasn’t getting AI efficient in 2023 (when the real run-rate savings materialized) doesn’t mean that they’re not getting AI efficient now. That said, remember when Klarna told everyone that AI made the company wildly more productive (shortly after rates went up and Klarna let a lot of people go)? The point is that management teams are good at telling investors what they want to hear, and if everyone wants to hear “AI productivity gains,” then that’s what management will tell.

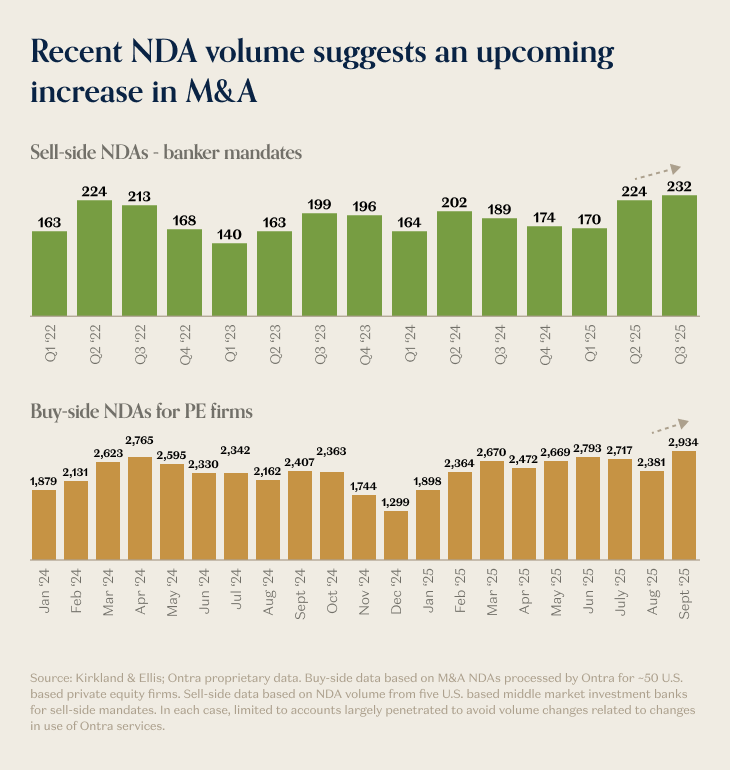

Hush-hush is the leading signal

While deal activity (by count) continues to slide off its ZIRP peak, there’s some evidence that an M&A boom is right around the corner.

According to the law firm, Kirkland & Ellis, the number of NDAs processed has spiked recently, on both the sell-side and buy-side (and why process a bunch of NDAs, if you’re not ready to deal?)

If we’re being totally honest, we’re not going to vouch for the veracity of the data or the strength of the signal, but it sort of passes the eye-test (as previous big jumps in ‘21, ‘23, and ‘24 were accompanied by a flurry of deal activity). Mostly, it’s just a neat-idea, and hopefully a bullish signal.

Views expressed in “posts” (including podcasts, videos, and social media) are those of the individual a16z personnel quoted therein and are not the views of a16z Capital Management, L.L.C. (“a16z”) or its respective affiliates. a16z Capital Management is an investment adviser registered with the Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. The posts are not directed to any investors or potential investors, and do not constitute an offer to sell — or a solicitation of an offer to buy — any securities, and may not be used or relied upon in evaluating the merits of any investment.

The contents in here — and available on any associated distribution platforms and any public a16z online social media accounts, platforms, and sites (collectively, “content distribution outlets”) — should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts provided here or on a16z content distribution outlets are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, posts may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein. All content speaks only as of the date indicated.

Under no circumstances should any posts or other information provided on this website — or on associated content distribution outlets — be construed as an offer soliciting the purchase or sale of any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by a16z personnel. Nor should it be construed as an offer to provide investment advisory services; an offer to invest in an a16z-managed pooled investment vehicle will be made separately and only by means of the confidential offering documents of the specific pooled investment vehicles — which should be read in their entirety, and only to those who, among other requirements, meet certain qualifications under federal securities laws. Such investors, defined as accredited investors and qualified purchasers, are generally deemed capable of evaluating the merits and risks of prospective investments and financial matters.

There can be no assurances that a16z’s investment objectives will be achieved or investment strategies will be successful. Any investment in a vehicle managed by a16z involves a high degree of risk including the risk that the entire amount invested is lost. Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available here: https://a16z.com/investments/. Past results of a16z’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results. Excluded from this list are investments (and certain publicly traded cryptocurrencies/ digital assets) for which the issuer has not provided permission for a16z to disclose publicly. As for its investments in any cryptocurrency or token project, a16z is acting in its own financial interest, not necessarily in the interests of other token holders. a16z has no special role in any of these projects or power over their management. a16z does not undertake to continue to have any involvement in these projects other than as an investor and token holder, and other token holders should not expect that it will or rely on it to have any particular involvement.

With respect to funds managed by a16z that are registered in Japan, a16z will provide to any member of the Japanese public a copy of such documents as are required to be made publicly available pursuant to Article 63 of the Financial Instruments and Exchange Act of Japan. Please contact compliance@a16z.com to request such documents.

For other site terms of use, please go here. Additional important information about a16z, including our Form ADV Part 2A Brochure, is available at the SEC’s website: http://www.adviserinfo.sec.gov

Happy to see ATOM Project plots still in the conversation!

https://atomproject.ai/

Ironically, EU’s AI Act effectively prevents SMEs (thus majority) from commercially using (Chinese) open-source AI due to downstream legal risks. Meanwhile, downloads of Chinese models are surging in the U.S. … welcome to the desert of Europe’s digital sovereignty. https://table.media/en/europe/opinion/double-lose-for-europe-how-the-ai-regulation-blocks-open-source-and-weakens-sovereignty